Infrastructures for stable assets with Curve

Growth of the TON Ecosystem

Since the beginning of 2024, TON has undergone significant changes, particularly in the DeFi space. At the start of the year, there were about 10 projects; now, there are 35, all of which are listed on DefiLlama. A key milestone was the launch of USDt, which confirmed that TON is actively strengthening its position in the DeFi landscape. The largest liquidity pools for USDt pairs have emerged on TON Blockchain.

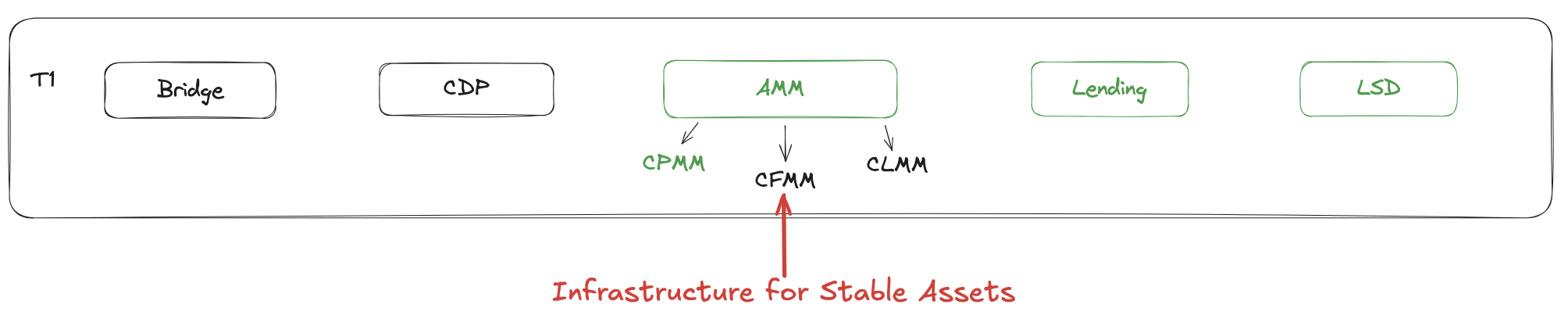

Currently, TON is nearing the completion of its first tier of DeFi primitives—we have already established lending solutions, liquidity staking, and CPMM model AMM protocols. Second-tier projects are also emerging, including launchpads, options, derivatives, and more. Upcoming plans include bridges between TON and other networks, such as BTC and EVM, which will allow the addition of new assets, including major stablecoins.

Infrastructure for Stable Assets

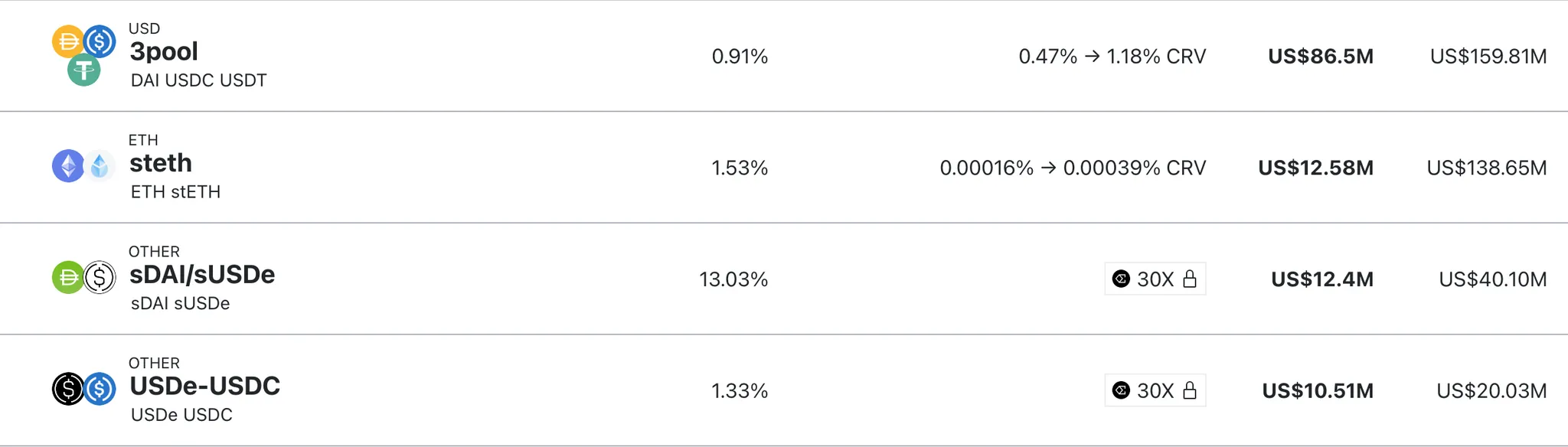

A crucial step will be the development of the CFMM (Constant Functional Market Maker) — a mechanism designed for the efficient trading of similar assets, such as stablecoins and Bitcoin derivatives, with minimal price impact during exchanges. TON Foundation supports this initiative by creating infrastructure for onboarding new stablecoins and similar assets from various networks. We have chosen the CFMM model as our first option, as it is optimal for upcoming assets. Curve-like Stable Swaps are best suited for these assets, providing decentralized exchanges that allow users to conveniently trade similar tokens such as USDC, USDt, FDUSD, DAI, and Bitcoin derivatives.

Collaboration with Curve Finance

To launch stable swaps on TON Blockchain, we joined forces with Curve Finance and Michael Egorov. Together, we initiated a competition for professional DeFi teams to develop CFMM model stable swaps. We received applications from 70 teams; 10 commenced work, and 5 reached the finals with completed CFMM protocols. Together with Curve, we carefully evaluated their code and experience, selecting winners during an online session that included 7 venture funds interested in potentially investing in these projects.

The winners of the competition were Torch Finance and Crouton Finance.

Short Term Results

This initiative, supported by Curve, enabled us to launch two stable swaps on the mainnet in just several months, achieving $300,000 in total liquidity and millions of active users through the projects' Telegram Mini Apps. TON Foundation and Curve plan to continue supporting these projects: Curve will serve as an advisor and grant access to the CFMM formula, while TON Foundation will allocate $150,000 to each project for audits, assist with initial liquidity in the pools for new stablecoins, and provide incentives for these pools.

Additionally, TON Foundation has collaborated with CrossCurve to integrate the cross-chain stable swaps using liquidity of Torch Finance and Crouton Finance into the CrossCurve DEX. Backed by the founder of Curve Finance, CrossCurve addresses the issue of liquidity fragmentation in DeFi.

Furthermore, TON Foundation and CrossCurve will launch $500,000 incentives for cross-chain pools, enabling stablecoin exchanges between the TON Ecosystem and EVM networks.

Seven venture funds, including TON Ventures, DWF Labs, GSR, Kenetic Capital, Foresight, Bitrue Ventures, and Paper Ventures, have made a soft commitment of $2.3 million for investments in Torch Finance and Crouton Finance.

Full version of our live judging session with VCs announcements:

https://www.youtube.com/watch?v=N8SBHClQ5UE

As a TON DeFi Lead, Vlad Degen, I would love to share three essential messages through this initiative.

Firstly, for professional DeFi teams, you can build a significant DeFi protocol on TON with the support of TON Foundation, our partners, and venture capital.

Secondly, venture funds constantly search for the right place and time to invest. The right place is the TON Ecosystem, and the right time is now.

Finally, we are actively developing DeFi for TON holders. The upcoming year will be the year of DeFi on TON.