Unlock Up to 20% APY: Ethena's Boost Campaign Now Live Across TON DeFi

We are continuing the USDe boost campaign, and extending it to October 24th. TON users can earn up to 20% APY by using tsUSDe across four DeFi platforms: Affluent, EVAA, STON.fi, and FIVA. We have also increased the cap for tsUSDe in DeFi that is eligible for the APY Boost to 20,000 tsUSDe.

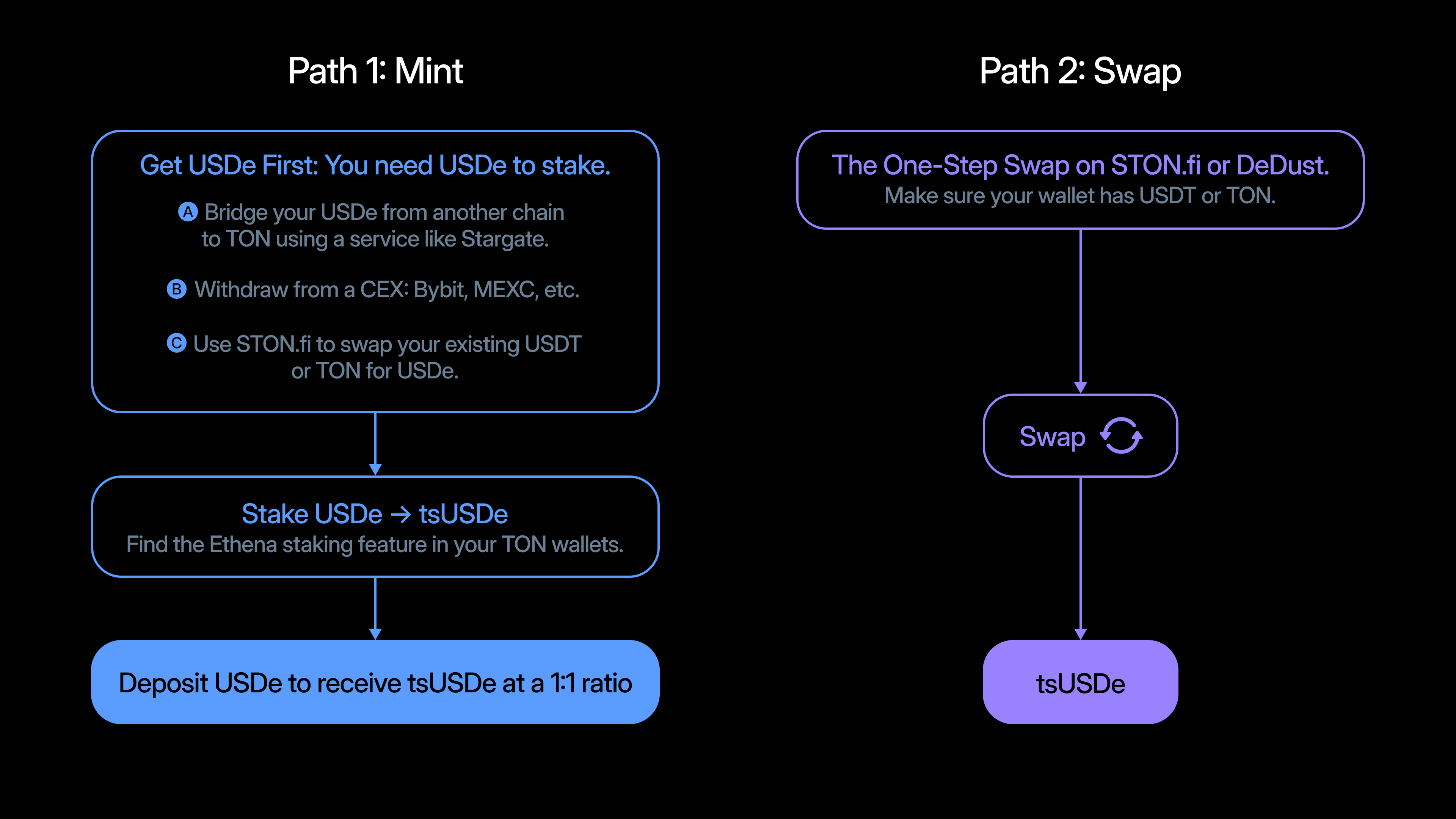

👉 New to USDe and tsUSDe? Start here with the complete guide.

How USDe and tsUSDe Work

USDe maintains its dollar peg while generating real yield through delta-neutral strategies - a departure from traditional stablecoins that rely solely on fiat backing.

When you stake USDe on TON, you receive tsUSDe, TON-native version that earns yield and qualifies for additional rewards throughout the ecosystem. Unlike USDe which maintains a $1 peg, tsUSDe appreciates in value over time as it accumulates yield.

The 20% APY Breakdown

Base Layer: Ethena's protocol-level yield from USDe/tsUSDe holdings

Boost Layer: Additional 10% APY on tsUSDe (Sept 26 - Oct 24th) for eligible users through:

- Holding tsUSDe directly in supported wallets

- Deploying tsUSDe in participating DeFi protocols

You can earn a 10% boost on up to 10,000 tsUSDe held in wallets and up to 20,000 tsUSDe deployed in DeFi protocols, with a combined maximum of 20,000 tsUSDe eligible for the boost. Beyond these limits, you continue to earn the base yield plus any protocol-specific returns.

📖 Complete boost details and FAQ

Four Protocols, Four Different Strategies

Automated Yield Management: Affluent (Up to 30% APY)

Affluent's Ethena Multiply Vault handles the complexity of yield farming automatically. Users can deposit tsUSDe, USDe, or USDT, and vault managers optimize returns without requiring constant monitoring or rebalancing. Withdrawals are processed according to vault availability and terms.

🔗 Try Affluent | Learn about the Ethena multiply vault strategy

Flexible Options: FIVA

FIVA provides distinct strategies for different goals:

- Purchase Principal Tokens (PTs) for fixed APY returns

- Purchase Yield Tokens (YTs) to speculate on yield performance

- Liquidity provision for steady income

- Leveraged strategies for those comfortable with higher risk profiles

🔗 Explore FIVA | FIVA x USDe strategy

Collateral and Borrowing: EVAA

EVAA enables tsUSDe to serve as collateral for USDT borrowing, opening advanced strategies like looping. With looping, you use borrowed USDT to acquire more tsUSDe, which serves as additional collateral for more borrowing - potentially amplifying both your tsUSDe position and boost eligibility. This approach can significantly amplify returns for experienced users who understand the associated risks.

Liquidity Pool Rewards: STON.fi

STON.fi's tsUSDe/USDe liquidity pool allows users to earn swap fees from trading activity, Ethena points, and up to 10% extra APY through the boost program. This is considered a lower-risk DeFi strategy, as liquidity providers benefit from multiple reward streams while maintaining boost eligibility.

🔗 Check STON.fi | How liquidity pools generate returns

Integration Benefits

The integration shifts the focus from passive holding to active earning strategies. Users can now access both stability and yield through established protocols with operational track records.

Each protocol has been tested and refined based on user feedback. The tsUSDe integration builds on existing infrastructure rather than requiring new systems.

🟢 Ready to get started?

Get USDe → Learn about maximizing returns

Disclaimer: The Open Network (TON) is an open and decentralized network where third-party applications build and operate independently. While their integration contributes to the ecosystem's growth, The Open Network does not control, formally endorse, or guarantee the performance of these projects. We strongly encourage all users to conduct their own thorough research (DYOR) and understand the associated risks before interacting with any application. Users assume full responsibility for the outcomes of their on-chain decisions.